Understanding Cap Rates in Industrial Real Estate: A Guide for Investors and Property Owners in Northern Virginia

In commercial real estate, capitalization rates (cap rates) are a critical tool for evaluating the property investment potential. Whether you’re purchasing, selling, or managing an industrial property in Loudoun, Fairfax, or Prince William County, understanding local market cap rates can help you make more informed decisions.

In this article, we’ll define cap rates, explain how they are calculated, and analyze industrial cap rates across Northern Virginia’s key submarkets, including Fairfax, Loudoun, and Prince William counties.

What Is a Cap Rate?

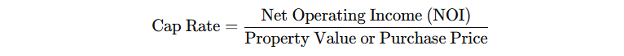

A capitalization rate, or cap rate, measures the expected rate of return on an income-generating property. It’s calculated by dividing the property’s net operating income (NOI) by its current market value or purchase price.

Cap Rate Formula:

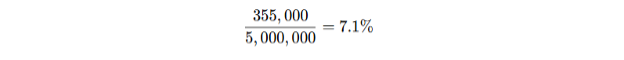

For example, if an investor purchases an industrial property in Springfield, VA, for $5 million and the property generates $355,000 in NOI annually, the cap rate would be:

This means the property is expected to generate a 7.1% return annually before considering financing costs, taxes, or capital expenditures.

Industrial Cap Rates Across Northern Virginia (2024)

Cap rates vary significantly by submarket, influenced by location, tenant demand, and economic conditions. Below is a snapshot of industrial cap rates across key Northern Virginia submarkets in 2024:

Key Takeaways from the 2024 Cap Rate Data:

- Woodbridge, VA, has the highest cap rate (7.5%), reflecting slightly higher risk or lower-priced assets relative to NOI.

- Reston has the lowest cap rate (6.0%), likely due to higher tenant demand, stable lease structures, and lower vacancy rates.

- Prime industrial areas like Tysons, Arlington, and Merrifield hover around 6.8%-6.9%, indicating investor confidence in these locations.

- Newington (7.3%) and Springfield (7.1%) are on the higher end, signaling potential investment opportunities for higher-yield seekers.

How to Interpret Cap Rates in Industrial Real Estate

Cap rates are often misunderstood as a definitive measure of an investment’s strength. In reality, they should be considered within the context of the market, risk tolerance, and long-term investment goals.

High vs. Low Cap Rates – Which is Better?

- Higher cap rates (7% – 7.5%) suggest higher return potential but may come with increased risk due to factors like property age, location, or lease structure.

- Lower cap rates (6% – 6.5%) indicate lower risk and more stable cash flow, often in well-established submarkets with strong tenant demand.

For instance:

- A warehouse in Woodbridge (7.5%) might offer a higher return but could have shorter lease terms or lower-credit tenants.

- A distribution center in Sterling (6.2%) likely attracts national tenants with long-term leases, making it a lower-risk investment.

Cap Rate Example in Action

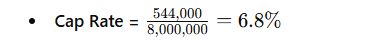

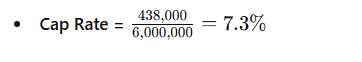

Imagine you’re comparing two industrial properties in Northern Virginia:

1. An industrial facility in Tysons Corner/McLean priced at $8 million with an NOI of $544,000.

2. A warehouse in Newington priced at $6 million with an NOI of $438,000.

If you’re seeking higher returns and don’t mind some risk, the Newington property (7.3%) may be a better fit. However, if you prioritize stability, the Tysons property (6.8%) offers a strong location with consistent demand.

Factors That Influence Cap Rates in Industrial Real Estate

- Location & Market Demand

Prime industrial submarkets near major highways and distribution hubs, like RT 28/Dulles North (6.2%), tend to have lower cap rates due to strong demand. In contrast, areas like Newington (7.3%) and Springfield (7.1%) have slightly higher cap rates due to more available space and evolving tenant bases.

- Lease Structures & Tenant Quality

Long-term leases with national credit tenants (e.g., Amazon, FedEx, or defense contractors) drive cap rates lower. Shorter leases or mom-and-pop tenants increase investment risk, leading to higher cap rates.

- Interest Rates & Economic Conditions

As borrowing costs rise, cap rates tend to increase to compensate for financing expenses. Investors should monitor Federal Reserve rate policies, as these directly impact property valuations.

- Property Condition & Age

Newer, Class A industrial spaces (high ceilings, modern loading docks, energy-efficient design) command lower cap rates, whereas older properties with functional obsolescence often trade at higher cap rates.

- Future Growth Potential

Cap rates should also be viewed in relation to the property’s future value. If industrial rents are projected to rise due to increasing demand (as seen along the I-66 corridor in Fairfax and Prince William County), a property with a slightly higher cap rate today may generate stronger returns over time.

Beyond Cap Rates: Other Metrics to Consider

While cap rates provide a quick snapshot of return potential, Cap rates are NOT

- A measure of appreciation potential

- A definitive risk assessment

- A standalone valuation metric

To get a better picture of the investment, cap rates should be used in combination with other financial metrics, such as cash-on-cash return, debt service coverage ratio (DSCR), IRR and price per square foot, to make a well-rounded investment decision.

- Cash-on-Cash Return – Measures actual return based on equity investment.

- Debt Service Coverage Ratio (DSCR) – Ensures NOI covers loan payments.

- Price Per Square Foot – Compares acquisition cost to market rates.

- IRR – Estimates the profitability of potential investment.

For a well-rounded investment strategy, cap rates should also be evaluated alongside lease terms, operating expenses, and tenant strength.

Limitations of Using Cap Rates Alone

While cap rates are valuable, relying on them alone can be misleading. Here’s why:

- Cap Rates Ignore Financing Costs – They don’t account for mortgage payments or leverage, which directly impact actual returns.

- They Don’t Reflect Market Cycles – A low cap rate today may not indicate long-term stability if the market shifts.

- NOI Can Be Misrepresented – Sellers may present inflated NOI figures that exclude expenses like capital reserves, deferred maintenance, or realistic vacancy assumptions.

Investors must verify NOI calculations and assess the broader financial picture, not just the advertised cap rate.

Key Takeaways

- Cap rates measure the expected return on an investment but are not the sole indicator of value.

- A lower cap rate typically signals lower risk, while a higher cap rate may suggest more potential return but with increased risk.

- Industrial cap rates in Loudoun, Fairfax, and Prince William Counties vary based on location, lease structures, tenant demand, and market conditions.

- Investors should combine cap rate analysis with other financial metrics for a complete investment picture.

Final Thoughts: How to Use Cap Rates in Your Next Industrial Real Estate Deal

The Northern Virginia industrial market remains strong, but cap rates vary significantly by submarket. Whether you’re a buyer, seller, or landlord, understanding where your property falls within this cap rate spectrum is essential for pricing and negotiation.

- If you’re buying: Look for cap rates that align with your risk tolerance and cash flow expectations.

- If you’re selling: Understand how your location and tenant mix impact valuation.

- If you’re a landlord: Competitive lease structures can reduce cap rates and increase property value.

Looking for insights on a specific industrial submarket? Let’s connect—I can provide custom cap rate analysis and strategic recommendations tailored to your investment goals.

📩 Contact me today to discuss your industrial real estate strategy in Northern Virginia!

LATEST POSTS

-

Understanding Cap Rates in Industrial Real Estate: A Guide for Investors and Property Owners in Northern Virginia

-

Deniz Senyurt Honored with Prestigious 2024 National Commercial Award

-

Election Results for the 2025 NVAR Board of Directors

-

Deniz Senyurt, CCIM, Announces Candidacy for 2025 NVAR Board of Directors Election

-

My Location Advisor Team Secures Padel Up As New Tenant For Prime Industrial Flex Space In Sterling, VA.

-

11 Proven Strategies to Supercharge Your CRE Prospecting Pipeline

-

Deniz Senyurt Receives 2024 Platinum Broker Awards!

-

CREATIVE CRE SALES STRATEGIES: SPLITTING THE LAND AND IMPROVEMENTS

-

CREATIVE SALES STRATEGIES : LEMONADE FORMULA

-

PITFALLS OF LEASING VS PURCHASING

-

LOCATION, LOCATION, LOCATION

-

HOW TO GENERATE PASSIVE INCOME FROM REAL ESTATE

-

REAL ESTATE INVESTMENT MISTAKES AND HOW TO AVOID

-

ALL ABOUT FORCE MAJEURE

-

OBSOLESCENCE IN REAL ESTATE

-

ADDING VALUE TO A PROPERTY